Eagle-Eye Your Payors

Protection of the Medicare program has reached new heights in recent years. One of the most important ways hospitalist groups can protect their Medicare funding is the discovery and recovery of improper contractor payments of Medicare claims.

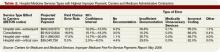

The Centers for Medicare and Medicaid Services (CMS) reviews various types of contractors—Medicare administrative contractors (MACs), carriers, durable medical equipment regional carriers (DMERCs), fiscal intermediaries (FIs), and quality improvement organizations (QIOs)—through its protection efforts as part of the Comprehensive Error Rate Testing (CERT) program and Hospital Payment Monitoring Program (HPMP). The CERT program’s contractors review physician (i.e., professional) claims processed by MACs and carriers.

The primary goal of a contractor is to “pay it right”—that is, pay the correct amount to the right provider for covered and correctly coded services.1 During the 12-month reporting period ending Sept. 30, 2007, the CERT program sampled 129,875 claims from carriers, DMERCs, FIs, and MACs.

The CERT contractor randomly and electronically selects about 172 claims each month from each type of claims-processing contractor. Since some of these contractors were transitioning to MACs, the target Part B (i.e., professional) sample size for the May 2008 report was approximately 2,000 reviewable claims per MAC cluster. However, this might have varied if a MAC was not processing claims during the entire sampling period.

Document Requests

Physicians need to be mindful of CERT requests for documentation. When possible, every attempt is made to benefit the physician. Initial CERT requests are attempted by way of a letter. If the physician does not respond within 30 days, the CERT contractor attempts one to three more contacts with correspondence and phone calls. If documentation is received after 75 days, it is considered “late.” It then will be reviewed, unless the reporting period has expired.

However, this should not be considered a prudent approach, and timely responses are ideal. If the physician offers no response, and documentation is not received, it is counted as a “no documentation” error.

Physicians often worry about accusations of fraud. The purpose of the CERT program is not to assume or accuse physicians of fraud, although it may serve as a deterrent. It does not, and cannot, label a claim fraudulent.

One scenario of potential fraud the CERT program is able to identify occurs when a CERT documentation contractor is unable to locate a provider or supplier when requesting medical record documentation.2